I am sitting around a table with not just one or two property investors, but three. All successful in their own right with quite different stories to tell, and all three have been brought together for a common cause, but more on that later.

Dave Morris and Gregg Reed have a similar story to tell as they both spent the majority of their working lives in corporate careers before turning their attention to property investment.

For Dave it was family that prompted the change of focus: "Like most people I meet, I wanted to have more choice with how I spent my time, especially with my youngest daughter. A successful corporate career as a sales director had been financially rewarding but had taken me away a lot when my eldest daughter was growing up and I wanted it to be different the second time around. I bought three apartments first, through a sourcing and property management company, without any knowledge or education. Not a route I would recommend. I got lucky with two of them as they were in London and I've now sold them and used them as part of the funds to develop my high cash-flowing personal HMO portfolio in and around Solihull in the West Midlands."

Dave left school with no qualifications however he went back into education to study IT which allowed him to work in sales for some of the largest IT companies in the world. "My career has given me an insight into how teams work but perhaps more importantly, for property, an ability to interact with people at all levels which is critical when I am dealing with agents, vendors, bankers etc. In property we are in the 'sales' game whether we want to be or not. We might be selling a great deal to a vendor, a room to a tenant or, as I do today, a great opportunity to an investor."

I'm intrigued to know why Dave chose property to invest in rather than another asset class. "I was attracted to property because of the ability to create a cash-flowing asset base now that would also appreciate in value over time. I could apply my business skills in setting it up and I knew that over time property has always increased in value so this gave me a way to pay down my portfolio and also leave a substantial inheritance for my two girls."

Gregg Reed has a similar story as he's spent most of his working career in corporate life with family being one of the main motivators for change. "Although I loved the challenge of the corporate world I grew tired of the bureaucracy and politics and the higher I went up the management structure the worse this got. The sudden death of a very close friend, who died of a brain tumour in less than six months from diagnosis, also made me realise that life is both precious and fragile and so I reflected on how I wanted my life to be rather than working for other people. The birth of my first son Harrison a few months later crystallised what life was really about and I knew I needed to find a way out of the corporate world as soon as I could."

Gregg Reed has a similar story as he's spent most of his working career in corporate life with family being one of the main motivators for change. "Although I loved the challenge of the corporate world I grew tired of the bureaucracy and politics and the higher I went up the management structure the worse this got. The sudden death of a very close friend, who died of a brain tumour in less than six months from diagnosis, also made me realise that life is both precious and fragile and so I reflected on how I wanted my life to be rather than working for other people. The birth of my first son Harrison a few months later crystallised what life was really about and I knew I needed to find a way out of the corporate world as soon as I could."

Again, property was something Gregg had considered for some time before deciding to invest in further education.

"I first became aware of the benefits of property in 2004 when watching programmes like 'Property Ladder' and 'Homes under the Hammer'. I realised that house prices doubled on average every 8-10 years and therefore it was a pretty exciting asset class. My initial plan was to just buy another property and when that doubled in value to sell it and pay off my mortgage."

Both Dave and Gregg decided to invest in further education to accelerate their journeys and it was through the property investors network (pin) that they met. Gregg managed to replace his corporate salary within the first eight months with an income of over £100,000 per annum and a portfolio value of £1.96m made up of properties that he either owns or controls.

Dave also managed to secure enough income from property during the 12-month course that he became 'financially free' and he was crowned the winner of pin's Mastermind 2013. "My strategy was very simple; I bought a house and converted it into an HMO. Then I found great professional tenants and repeated the process several times. Along the way I got to know that one of my tenants worked for a charity supporting recovering addicts and through that discussion I realised that high quality accommodation was not easy for them to find. That led to me doing a Rent-2-Rent deal through an agent I knew on a six en-suite bedroom property where I acted as the middle man and used my specialist knowledge to put the correct contracts in place. The owner receives the full rent he was asking for and I pass it on to the charity with a 35% discount compared to the going rent as a HMO. Everyone wins; the owner gets full rent for 20 months, the charity gets six rooms at a significant discount and I make my profit from my specialist knowledge."

Both Gregg and Dave have built up their portfolios using a mixture of strategies and both investors started by relying on a sourcing company to find properties for them.

The third investor sitting across from me however has a slightly different tale to tell. Dan Norman has a more entrepreneurial background: "From University I went straight into promoting night club events during the day and I was also a professional DJ for almost 10 years in the clubs at night. I started out self-employed for the larger leisure companies but by 2001 I had a limited company that allowed me to purchase another promotional company in 2002. The promotional activity still does well today under specific management. I learnt the importance of building a loyal team, working with mutual respect and trust with partners, putting in the hours and when to push hard and when to back away from a deal or location. I also gained an overview of building and running a company with the correct structure and legality."

Unlike Dave and Gregg, Dan starting investing in property as soon as he could: "I'd always wanted my own property so I bought straight from University in 1997 with a 95% mortgage and parental guarantee as while the property was affordable for me, I was working just on commission. Though in the back of my mind I knew it made great financial sense, it was a bit of a lark as four mates moved in with me on a small rent while we cosmetically refurbished the house. I had an HMO without knowing it. However, it took 6 years to purchase my next property as I hadn't recognised how powerful it could be and failed to take action."

Unlike Dave and Gregg, Dan starting investing in property as soon as he could: "I'd always wanted my own property so I bought straight from University in 1997 with a 95% mortgage and parental guarantee as while the property was affordable for me, I was working just on commission. Though in the back of my mind I knew it made great financial sense, it was a bit of a lark as four mates moved in with me on a small rent while we cosmetically refurbished the house. I had an HMO without knowing it. However, it took 6 years to purchase my next property as I hadn't recognised how powerful it could be and failed to take action."

Dan managed to build his portfolio through a joint venture partner he found whist renovating his property. "My first house had no lounge for a short period due to all the rooms being occupied, so I extended [and the work] was managed by another friend's Dad. He was looking for someone to invest with and assist in ongoing refurbishment projects. Subsequently we bought, refurbished and sold 30 properties as JVs in a few local postcodes in Birmingham. He flipped for income but I wanted [to hold] some long term so I retained 10 of these by 2013 to build a modest portfolio.

Like Gregg and Dave, Dan also joined the pin mastermind programme and that's enabled him to work with new joint venture partners and further develop properties. His real passion is in turning old ugly buildings into something habitable.

Now I've got an understanding of what all three investors bring to the table and how they all met, I'm curious to find out why they've joined forces. Gregg explains: "I'd worked with the homeless sector as part of my corporate career at Cadbury so I understood what challenges people face to get accommodation. There's just not enough housing in this country for everyone and so for those at the poorest end of society there is very little chance of getting somewhere they can call home. I also saw the poor standards of the housing stock made available by private landlords and I knew there was so much more that needed to be done to improve the lives of people who were already at their lowest point.

"When I met Dave and Dan it was clear that we had complimentary skill sets and enjoyed working together. They (Dave and Dan) also had accommodation for people in the homeless sector, so it was a natural progression for us to join together and form New Leaf Living. We all know our strengths and weaknesses and the things I'm awful at doing or don't enjoy are things that Dave or Dan love to do and excel at so working together is effortless.It's a great combination for a business partnership."

Now all three are financially free they are focusing some of their time on this new venture - New Leaf Living (NLL). So what exactly is it?

Now all three are financially free they are focusing some of their time on this new venture - New Leaf Living (NLL). So what exactly is it?

Dave Morris responds: "It's a partnership formed by three professional property investors to address the plight of homeless people in Birmingham. It's a socially responsible enterprise that uses the knowledge and experience of the partners to benefit the more vulnerable in our society whilst creating fantastic income for investors who support the business. New Leaf Living provides the quality accommodation for the homeless people and works in partnership with companies providing supported living services to the individuals.

"Our ethos is to provide long-term solutions to homelessness and not short-term fixes. It's easy to buy a house and put people in it but the real success is to help people to rebuild their confidence and to contribute to society. Our aim is for them to achieve stability in their lives and for them to gain employment."

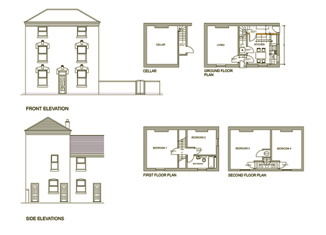

In essence, NLL uses funds to purchase property suitable for HMO accommodation and then manages the refurbishment process, which is where Dan's development experience comes in. Once the property is fully renovated NLL lease the property to a housing association for a discounted rent on a fixed term basis. NLL uses the profit to pay down debt and any investor funds used to purchase the project. The project was initially funded by the three partners in order to prove that the model works and they now work with investors to fund growth.

Gregg adds: "The model we use for New Leaf Living is the same proven model that made Dave, Dan and I financially free. The difference here is that we work with housing associations rather than letting agents and we pass on the benefits of the cashflow to our investors rather than holding on to all of it for ourselves."

It's worth noting this isn't a not for profit venture and ultimately the company benefits from the long term growth of the properties as the investors they work with receive a fixed income over a set period in exchange for the loan. One of the reasons NLL works with housing associations is because they can offer the specific support needed by the tenants. Although, I am curious to understand why NLL offers their properties at below market rent rates. Gregg explains: "Once a tenant is warm, safe and dry the challenge is for them to re-build their self-esteem and then move on with their lives. With the right level of support this is relatively straightforward where the client is educated or already has vocational skills. However, barriers to clients moving are employability (lack of skills), employment levels in the area (lack of jobs) and the low rates of pay versus benefits (lack of motivation!).

"At NLL we help to overcome this by charging the Housing Association a lower than average market rate for our property. This enables them to build-up a surplus that is used to bridge the gap between the minimum wage and housing benefits so it allows the individual to remain in their home rather than being forced to move out just because they got a job."

Now the trio has established the model, they are looking at other ventures that support their vision. For example, NLL has just bought a former public house at auction with the view of creating quality accommodation along with a commercial enterprise 'with facilities for developing the vocational and business skills required for our clients to gain employment.'

Gregg says: "New Leaf has a target of delivering 180 quality places to call home this year and we are currently up to 45. Now we have a proven model that the commercial banks are really supporting, as well as our private investor base, so we'll scale up our operation by inviting more people to invest with us."

All three investors bring something to the table in this venture. Gregg says: "Between us we have over 30 years of property investing experience and we continually update our knowledge by attending property courses and keeping close to changes in legislation and regulation. We are also operating in the property market on a daily basis and this keeps our finger on the pulse.

"We also

"We also